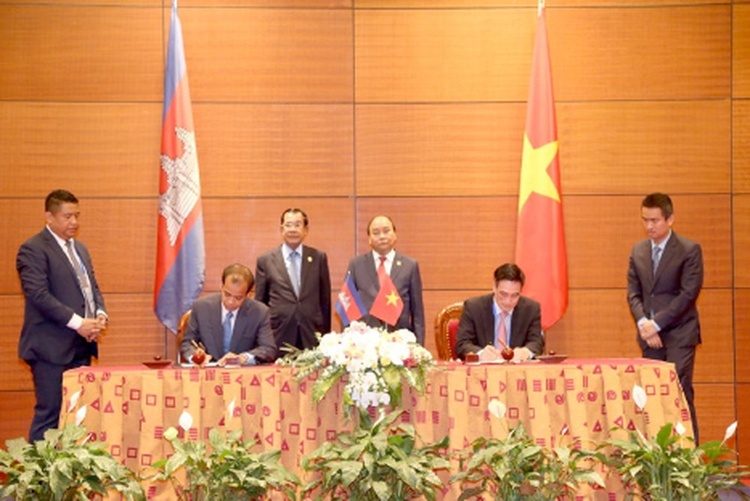

On the occasion of the 6th GMS Summit and the 10th Cambodia-Laos-Vietnam Development Triangle Cooperation Summit, the Ministry of Finance Vietnam and the Ministry of Economy and Finance of Cambodia have officially signed the Double Taxation Avoidance Agreement and the avoidance of tax evasion of taxes on income between the Government of the Socialist Republic of Viet Nam and the Government of the Kingdom of Cambodia.

In 2017, the total value of exports and imports between Vietnam and Cambodia reached US $ 3,796.7 million, a 29.7% increase compared to 2016.

Of this total, Vietnam's exports to this market reached USD 2,776.1 million, an increase of 26.1% and that of goods imported from Cambodia was USD 1,020.6 million, up 40.6% compared to 2016. The two sides are striving to increase bilateral turnover to $ 5 billion in the coming years.

In terms of investment, Cambodia has 18 investment projects in Vietnam, with a total registered capital of US $ 58.1 million, ranking 51st out of 116 countries and territories investing in Vietnam. Male. Of which, there is one investment project in the field of agriculture and forestry, with a total investment capital of $ 45 million. The remaining projects are small scale and invest in areas such as transportation, warehousing; processing, manufacturing and trading.

Currently Vietnam has 196 investment projects to Cambodia, with a total registered investment of 2.94 billion USD. Cambodia ranks third among 68 countries and territories investing in Vietnam abroad (after Laos 5 billion USD and Russia nearly 3 billion USD) and Vietnam is ranked at 6th place. Cambodia (after China, Thailand, Japan and South Korea, Hong Kong). Vietnam's investment projects in Cambodia are concentrated in agriculture (accounting for nearly 70% of total registered capital), finance - banking - insurance (accounting for 9.4%), telecommunications 7.5%).

Given the economic, trade and investment situation between the two countries, the signing of the Double Taxation Avoidance Agreement between Vietnam and Cambodia will contribute to promoting trade and investment cooperation between Vietnam and Cambodia, Creating a clear, stable tax environment for Vietnamese and Cambodian investors to develop and expand their business-investment activities. At the same time, indirectly enhancing the comprehensive cooperation in the fields between Vietnam and other Asian countries in general and ASEAN countries in particular.

For more details, see the attached file. Download attachments 2 file

Vietnam Trade Office in Cambodia